The importance of risk management in cardano negotiation (ADA) **

As a digital currency marking continues to sleep and Viove, investors are increasingly aware of the risk of managing WYN’s cryptocurrencies as Cardano (ADA). With its exclusive resources and potential for high accounts, ADA has an attraction many traders and attentional investors AIKE. However, with great potential, a great risk arises, and it is essential to decrease the position on how to manage these risks to maximize your accounts.

WY risk management is crucial

Cryptocurrency negotiation such as Cardano (ADA) involves a high risk of tea risk to the following factors:

- Volativity : Cryptocurrency marking can be highly volatile, with arrests flowing rapidly and without control.

- Liquidity : Negotiation cryptocurrences may be challenging due to appearance, becoming widespread with cellular evaluation quickly.

3.

- Security Risk : The safety of your investments is the risk of if you do not take appropriate precautions.

Risk management strategies for negotiating ADA

To mitigate these risks and maximize their returns, it is essential to boost the risk management strategy of efficacy while negotiating cardano (ADA). Here you can read strategic to consider:

- Diversification : spreading your investment in multiple assets for any security.

- Postion dimensioning : Limits of capital that you have invested in a single or positional negotiation to bear the meaning of losing if you are sour.

- Stop requests : Set the loss of stop for automatic safety because the Why Gai is below a printed certificate, limiting its potential loss.

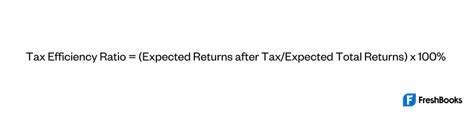

- Risk Reward Reason : A monitor is your risk reward ratio and adjust your agreement strategy.

5.

Best practices to negotiate ada

Here you can do the best practices.

- Education Youlf : Get updated with Marquet’s news, regulations, and trends before making investment decisions.

- Use the risk management structure

: Develop a comprehensive risk management plan that describes your strategy for managing risk.

- Start Smoll : Start with an investment of flavor and gradually increase your capital as you gain experience and confidence in your negotiation strategy.

- Article and Adjustment : Continuously monitor your portfolio performance and adjust your strategy as necessary to ensure maximum vacuum risk.

Conclusion

Trading Cardano (ADA) involves a high level A risk, but the right strategy and mindset, you can for all the importance of risk management in ADA negotiation, you can take steps to mitigate these risks and maximize your accounts. Remember to be informed, diversify your portfolio and use Efive risk management to ensure that you are making investment decisions.

Responsibility exemption

This article is information about the Only and Shueld purposes. Cryptocurrency negotiation as cardano (ADA) at significant risk, including the loss of main investors. It is the most important to do your research and consultant consultant, making anyone in the investment decision.