invisible adoption price: how gas fees affect Shiba Inu (Shiba)

Because the cryptocurrency market is constantly growing and maturing, one aspect that drew significant attention is the impact of gas fees on various cryptocurrencies, including popular shard platforms, such as Ethereum. Token Shiba Inu (Shiba), the native cryptocurrency of the Shiba Inu ecosystem, has recently gained adhesion, but its acceptance did not occur without costs – in particular high gas fees.

What are gas fees?

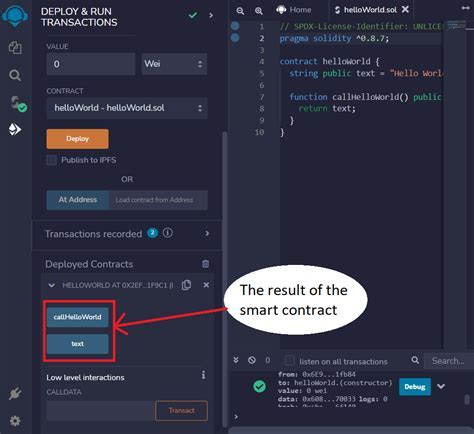

Gas fees relate to small fees charged by the blockchain networks for each computing energy unit that is used to validate transactions and perform intelligent contracts. These fees may vary depending on the capacity of the network, use patterns and other factors. In the context of Ethereum and other shard platforms, gas fees play a key role in determining the usability of the network.

Shiba Inu (Shiba) and gas fees

As the native cryptocurrency of the Shiba Inu ecosystem, Shib is designed so that it is supported by a decentralized network that is based on the Ethereum 2.0 Proof-V-Stake (POS) consensus mechanism. This means that users can extract shib using their own computer resources or rent them from other users.

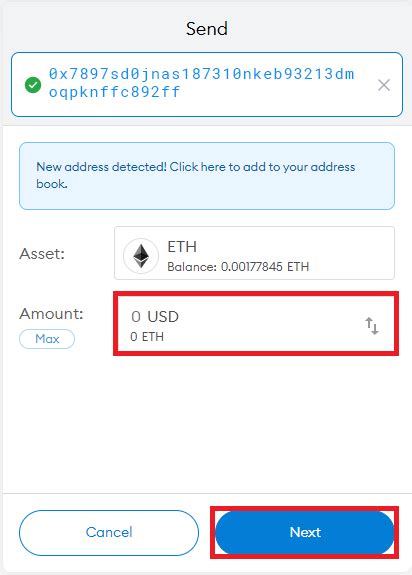

However, as in the case of any blockchain based system, gas fees play a significant role in determining the costs of transactions and intelligent implementation of contracts. According to estimates, each transaction on Ethereum 2.0 usually incurres an average fee of $ 5-10. This means that if you are trying to make a simple transaction, such as buying or selling shib, you will have to face significant fees that could eat profit margins.

The impact of gas fees on Shiba Inu

This is not a surprise for Shiba Inu enthusiasts (Shiba). As the token increases, just like gas fees related to its use. According to estimates, Shiba is one of the most expensive tokens to extract and use in Ethereum 2.0 networks.

While some can argue that high gas fees are a small concern for users who only need to make transactions from time to time, it is necessary to understand wider implications for the Shiba Inu ecosystem as a whole. When the token gains more mainstream adhesion, we can expect an increased demand for its cases and use services.

The future of gas fees

In the light of growing gas fees, both programmers and users are looking for ways to alleviate this cost. Some potential solutions include:

* Staking and proof-off-stake mechanisms (POS) : Staking allows validations to block your assets and earn prizes in exchange for maintaining network security.

* Pools of liquidity : Pools of liquidity allow users to combine their resources with others, enabling them to use lower fees when making transactions or using Shib.

Application

Since Shiba Inu is still gaining adhesion, it is necessary for tokens and users to be aware of the impact of gas fees on their general costs. Although high gas fees may seem a significant obstacle, they can also increase innovation and adoption in the ecosystem, because developers are looking for ways to reduce these costs.

To sum up, although the cost of gas fees is a key aspect of taking cryptocurrencies, it is necessary to understand its consequences for individual token owners and users. By studying solutions such as the mechanisms of setting and POS, liquidity pools and other profitable options, we can ensure that Shiba Inu remains available to everyone, regardless of our level of experience or resources.

Sources:

- “Ethereum 2.0: A new era for decentralized finances” by David Murphey

- “Shiba Inu (Shiba) price and gas fees” by Coindesk

- “Shiba inu tokenomika” by cryptozlat